The 5 worst financial disasters and recessions in history (and what they taught us)

What lessons can we learn from the world's worst financial disasters as the cost of living rises?

Get the world’s most fascinating discoveries delivered straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered Daily

Daily Newsletter

Sign up for the latest discoveries, groundbreaking research and fascinating breakthroughs that impact you and the wider world direct to your inbox.

Once a week

Life's Little Mysteries

Feed your curiosity with an exclusive mystery every week, solved with science and delivered direct to your inbox before it's seen anywhere else.

Once a week

How It Works

Sign up to our free science & technology newsletter for your weekly fix of fascinating articles, quick quizzes, amazing images, and more

Delivered daily

Space.com Newsletter

Breaking space news, the latest updates on rocket launches, skywatching events and more!

Once a month

Watch This Space

Sign up to our monthly entertainment newsletter to keep up with all our coverage of the latest sci-fi and space movies, tv shows, games and books.

Once a week

Night Sky This Week

Discover this week's must-see night sky events, moon phases, and stunning astrophotos. Sign up for our skywatching newsletter and explore the universe with us!

Join the club

Get full access to premium articles, exclusive features and a growing list of member rewards.

Economies around the world are reportedly on the brink of the worst financial disaster in recent times, as the cost of living is set to increase during 2022. In the U.K. in particular, may see another recession, according to the Telegraph, while inflation has already risen to a 30-year high of 5.5%, according to The Guardian.

According to the Institute for Government inflation in the U.K. is set to peak at 7.25% in April, 2022. As this outstrips any wage increase, tax increases (also beginning in April), seem ready to punch a further hole in the population's wallets. It is possible that Britain will once again be facing a period of 'stagflation', similar to the economic downturn in the 1970s, according to The Evening Standard.

Over the centuries there have been many similar fiscal disasters, economic crashes and global crises that have wrought havoc on national finances and family incomes. From the Credit Crisis of 1772, to the Great Recession of 2008, many of these events have left us with important lessons in how to deal successfully with the situation we face today.

Here are five of the worst financial disasters and recessions in history, and what we can learn from them.

The 1772 credit crisis

In June 1772, the London bank of Neale, James, Fordyce and Down collapsed following a loss of approximately £300,000 (equal to approximately £48.8 million or $64 million in today's money) worth of speculative stock in the East India Company (EIC). Immediately panic set in as bankruptcies rose across London, and almost every private bank in Scotland became bankrupt according to Global History. The crisis quickly spread to several Dutch banks before the markets were eventually calmed, according to Liberty Street Economics.

However, the crisis most severely impacted the EIC, and the company faced a huge cash shortage, Liberty Street Economics stated. To prevent the EIC from collapsing, in 1773 the British government passed the Tea Act, which granted the company a monopoly on North American tea sales, according to the Boston Tea Party Museum. It was due to this act that on Dec. 16, 1773, American patriots threw 342 chests of tea into the sea in a protest which became known as the Boston Tea Party.

Related: 13 significant protests that changed the course of history

Get the world’s most fascinating discoveries delivered straight to your inbox.

According to Liberty Street Economics: "Much has been done to understand credit exposure since the late 1700s." Now we have services which help to stop history repeating itself. "Credit rating agencies provide these services for both corporations and individuals today" they state.

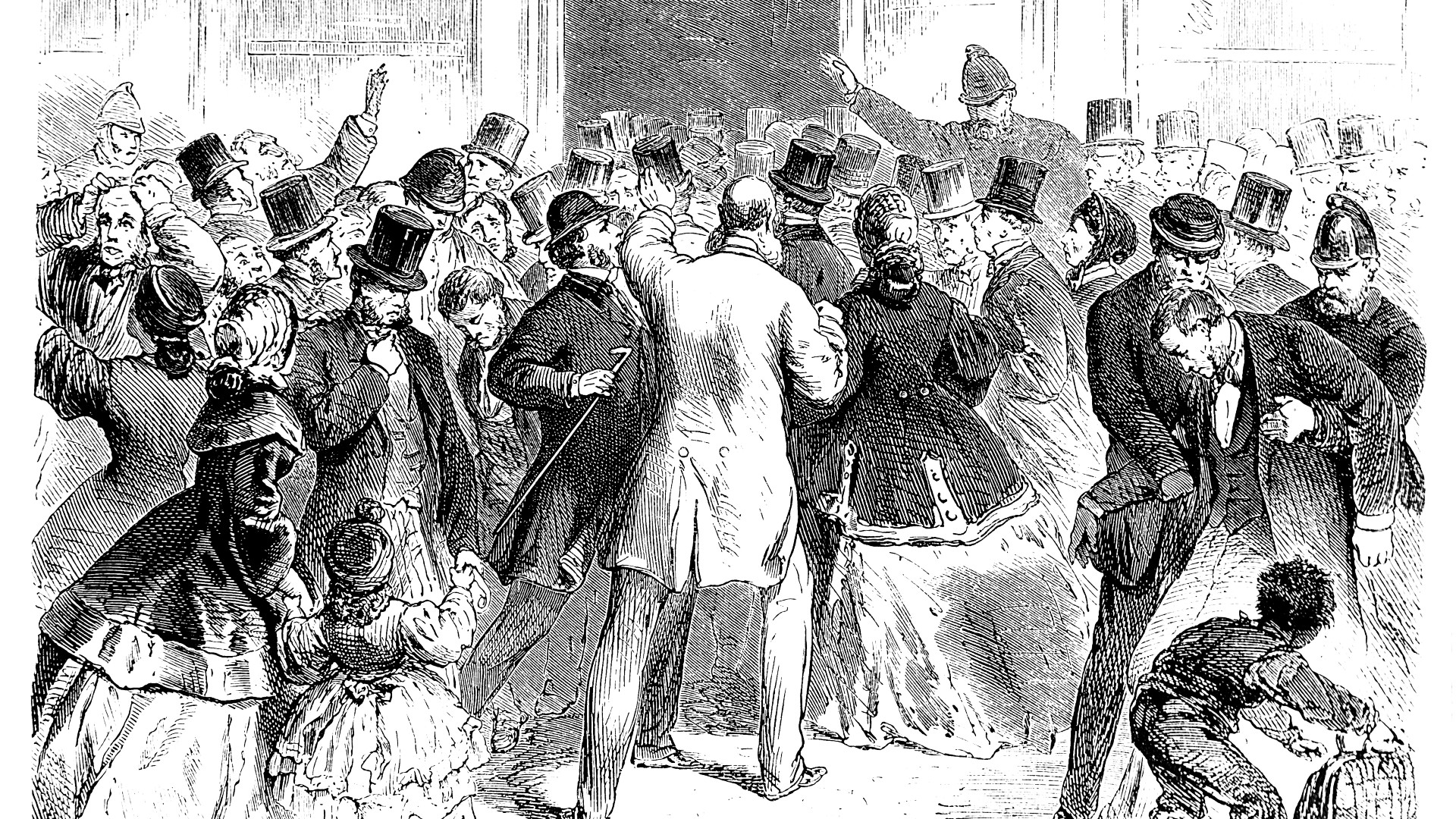

Panic of 1873 and the 'Long Depression'

The original 'Great Depression' (according to an article by the Institute of Economic Affairs, this term was used up until the 1950s), the Long Depression began in 1873 with the collapse of the Vienna Stock Exchange, according to the historical site, The World of the Habsburgs. In Britain the panic resulted in a nearly two-decade-long period of economic stagnation, according to American History USA.This is now known as the Long Depression, because it lasted at least 23 years.

The demonetization of silver in Germany and the United States, as well as increased speculative investing are some of the often cited causes of the disaster.

Michel Beaud, in his paper: "From the Great Depression to the Great War" wrote: "The stock exchange in Vienna was followed by bank failures in Austria and then in Germany." Beaud claims that price rises and less profitability had a knock-on effect on German industry, with the prices of cast iron falling some 27%.

In the U.S., banks such as Jay Cooke & Co raised finances through selling bonds, particularly relating to the railways., As construction costs ballooned Jay Cooke & Co and other banking houses collapsed, according to the Library of Congress. The result was that on Sept. 20 , the New York Stock Exchange was forced to halt trading for the very first time. According to Beaud, in Britain exports fell by 25% while unemployment almost doubled (7,490 in 1873 and 13,130 in 1879).

One of the key causes of the 1873 crisis was the rapid increase in commercial and industrial productivity, according to Stephen Davies, the head of education at the Institute of Economic Affairs . "[This] created many new products but also led to very large adjustments as older industries shrank. There was also a shift in the focus of the world economy, towards the new developing parts of the world such as Germany and the U.S." Davies wrote for the Institute of Economic Affairs, citing Irving Fisher.

Davies states that the lesson to be taken from the 1873 crash, which to him mirrored issues in 2012 is that: "the underlying problem is one of a long-term economic realignment rather than a simple decline in demand."

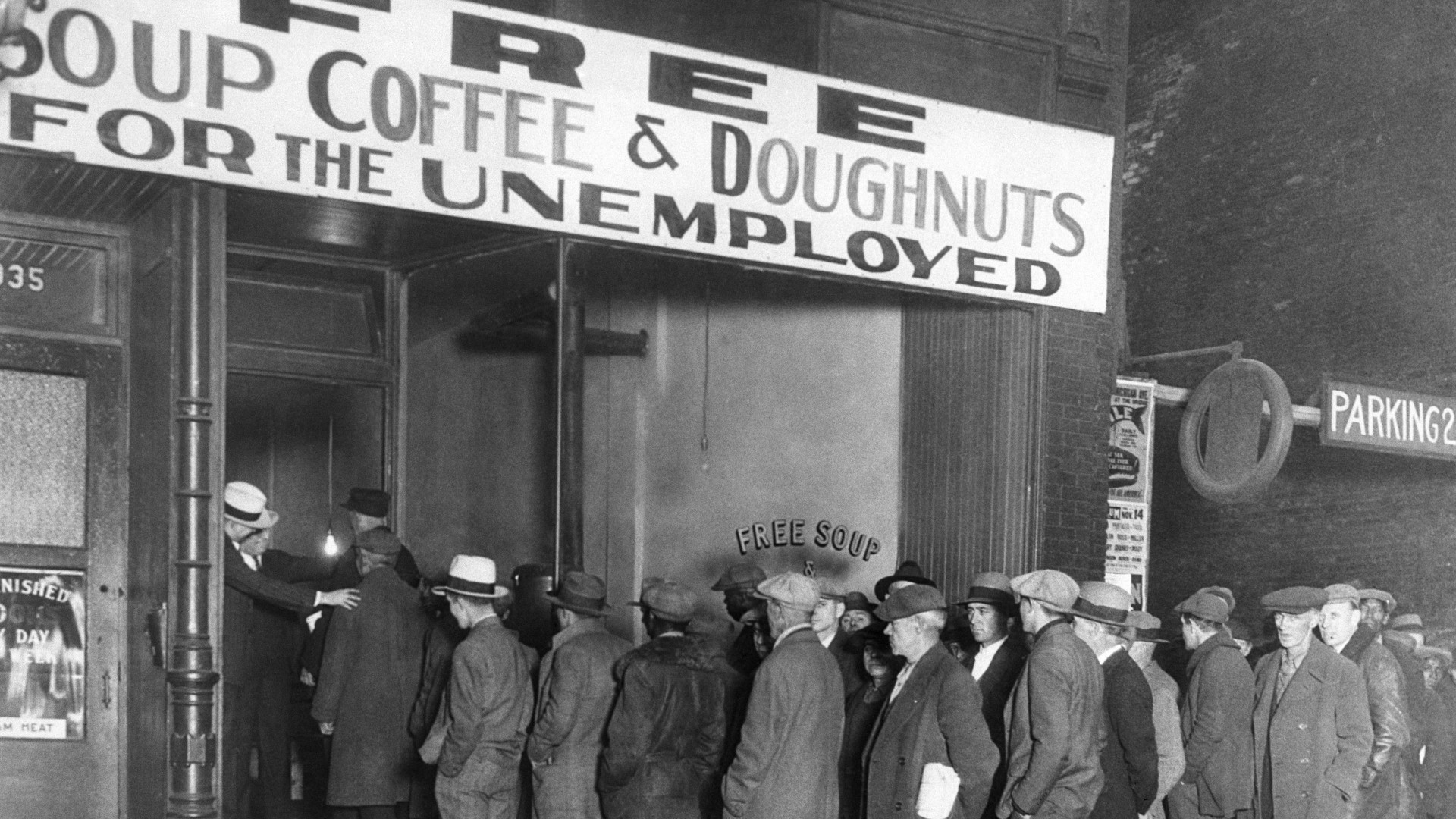

The Great Depression

On Oct. 24, 1929, the U.S. stock market crashed following 18 months of speculative buying, according to the Khan Academy. Coupled with a weak banking system, industrial overproduction and collapses in farming prices, the crash triggered a financial crisis that was became referred to as 'The Great Depression'.

The Great Depression was "one of the worst disasters in American History", according to Ben Bernake, a member of the Federal Reserve's Board of Governors.

The U.S. economy shrank by 50% within five years, and around 15 million people were out of work.By 1933, 4,000 banks had failed, according to The Balance.

The Great Depression had a huge impact on the global economy. In Britain, the value of exports were halved and unemployment doubled to 20%. It was only in 1931, after the pound was devalued by 25% in 1931, that the British economy began to recover, according to The British Library.

In Germany, the Great Depression has often been considered a factor in helping the rise of the Nazis, although a 2017 paper also stated the importance of austerity measures imposed by Chancellor Heinrich Brüning, according to Vox. In numerous countries, the depression was linked to the rise of fascism.

In the U.S., Franklin D Roosevelt launched his 'New Deal' series of economic policies in an attempt to save the nation's economy. Launched in three waves from 1933 to 1939, they focussed on creating jobs for the unemployed, providing farming and agricultural assistance, social security (a form of pension) and increased labour rights. According to The Balance, historians have described the programme as 'capitalism with safety nets and subsidies' and many things it introduced (such as minimum wage and social security) are still important today.

Economic crisis of the 1970s

During the late 1960s, inflation was rising across the world, but particularly in the U.S. and U.K. The crisis began with the Yom-Kippur war between Israel and a coalition of Arab states began on Oct. 6, 1973, according to The Guardian. The conflict triggered a sharp rise in oil. The oil crisis, "knocked the wind out of the global economy and helped trigger a stock market crash," The Guardian reported.

In the U.K. inflation rose to over 20%, finally hitting a high of 24%, according to Deloitte. This was due not only to the oil crisis but also rising wages, the budget of 1972 (which included large tax cuts) and further growth in consumer spending, according to Economics Help.

On Nov. 6, 1972, the British government attempted to place a cap on wages to curb inflation, but this led to a Coal miners strike, according to the BBC. This strike resulted in a fuel shortage, and in 1974 Prime Minister Edward Heath was forced to implement a three-day week, with the nation's electricity supply rationed, according to The Blackout Report.

By the summer of 1975 the cost of living in Britain had risen to 26%. This was the first time that the country experienced both a rise of unemployment and inflation at the same time, known as 'stagflation', a phrase coined by Ian Macleod.

In January 2022, The Times Money Mentor published an article that suggested stagflation could once again return to the U.K., with inflation already rising to 5.4% in December 2021. As of writing, the current Gross Domestic Product (GDP) Growth Rate is only 1%, according to Trading Economics. With energy prices already on the rise, there seems to be much we can learn from this crisis.

Great Recession 2008

The financial crash and global recession of 2008 was "the worst economic disaster since the Great Depression of 1929", according to The Balance. The crash was triggered primarily by the collapse of the U.S. Housing Market, according to Investopedia. In Britain, Northern Rock was the first to feel the issues in the U.S. sub-prime mortgage market. When its issues were made public, a run on the bank was triggered according to The Bank of England. Back in the U.S., on Sept. 15, 2008, Lehman Brothers (an investment bank founded in 1847) collapsed triggering a global financial crash.

In Britain, the recession officially began on Jan. 23, 2009, when the Office for National Statistics reported that, for the last two quarters of 2008, the economy had shrunk, according to The Guardian. As a result of the recession the British Economy took five years to recover and by the end of 2011 some 2.7 million people were unemployed, according to the Office for National Statistics.

The Federal Reserve Bank of St Louis in 2011 gave a lecture on 'Lessons Learned from the Financial Crisis'. In this they stated, among other points, that: "High levels of debt, uncertain ability of borrowers to repay debt and an expectation that housing prices will always increase (among other factors) created a comfort level that was misguided".

Additional resources

If you are suffering due to the cost of living crisis, Big Issue has a handy article providing details where you can find support. For more information on what the crisis actually means, Huffington Post breaks down the current financial disaster. For more on historical recessions, The Guardian provides a short history.

Bibliography

- Lauren Almeida; "Will there be a recession in 2022? How to protect your savings and investments" The Telegraph, 14th February 2022

- Phillip Inman; "UK inflation rises to 30-year high of 5.5% amid cost of living crisis", The Guardian Wed 16th Feb 2022

- Institute for Government: Cost of Living Crisis

- Simon English, "Stagflation is here as Omicron hits UK economy", The Evening Standard, 11th Feb 2022

- James Narron and David Skeie "Crisis Chronicles: The Credit and Commercial Crisis of 1772" Liberty Street Economics, March 7th 2014

- From Tea-Panic to Tea-Party: The Tontine Coffee House

- Steve Davies, "Lessons from the 'Long Depression', Institute of Economic Affairs, 3rd January 2012

- American History USA

- The World of the Habsburgs

- Micheal Beaud: "From the Great Depression to the Great War" A History of Capitalism 1500-1980, Palgrave Macmillan 1981

- Kimberly Amadeo; "9 Principal Effects of the Great Depression" The Balance, January 27th 2022

- The Great Depression and US Foreign Policy: The Office of the Historian

- The British Library

- Dylan Matthews; "Study: Austerity Helped the Nazis Come to Power" Vox, Dec 12th 2017

- Terry Macalister; "Background: What Caused the 1970's Oil Price Shock?", The Guardian, 3rd March 2011

- "Inflation: Please, not back to the 1970s", Deloitte, 20th Sep 2021

- The Economy of the 1970's - Economics Help

- On This Day - BBC

- The Blackout Report

- Emily Hardy; "The Last Time Unemployment was this Low was 1974", This Is Money, 24th June 2019

- Tom Rogers: "Is stagflation coming to the UK? The 1970s revival nobody wants" The Times Money Mentor, 19th Jan 2022

- Trading Economics

- Investopedia

- The Bank of England

- Graeme Wearden; "Timeline: UK Recession", The Guardian, 23rd Oct 2009

- Office for National Statistic

Callum McKelvie is features editor for All About History Magazine. He has a both a Bachelor and Master's degree in History and Media History from Aberystwyth University. He was previously employed as an Editorial Assistant publishing digital versions of historical documents, working alongside museums and archives such as the British Library. He has also previously volunteered for The Soldiers of Gloucestershire Museum, Gloucester Archives and Gloucester Cathedral.

Live Science Plus

Live Science Plus