Unhappy Returns: Climate Change's Big Tax on Americans

Mindy Lubber is the president of Ceres, a non-profit organization mobilizing business leadership on climate change. She contributed this article to LiveScience's Expert Voices: Op-Ed & Insights.

Crop losses. Floods. Wildfires.

Climate change and extreme weather are fundamentally changing the United States, and American taxpayers are paying a huge, and growing, cost.

The U.S. Government Accountability Office warned in February that climate change is a "significant financial risk to the federal government." It threatens everything — not just federal lands and buildings, but food, flood and crop insurance, and disaster relief.

And who pays for all of this? We do, the American taxpayers — a threat to the government's wallet is a threat to our own bottom line. Here are several examples of the escalating costs Americans are already bearing.

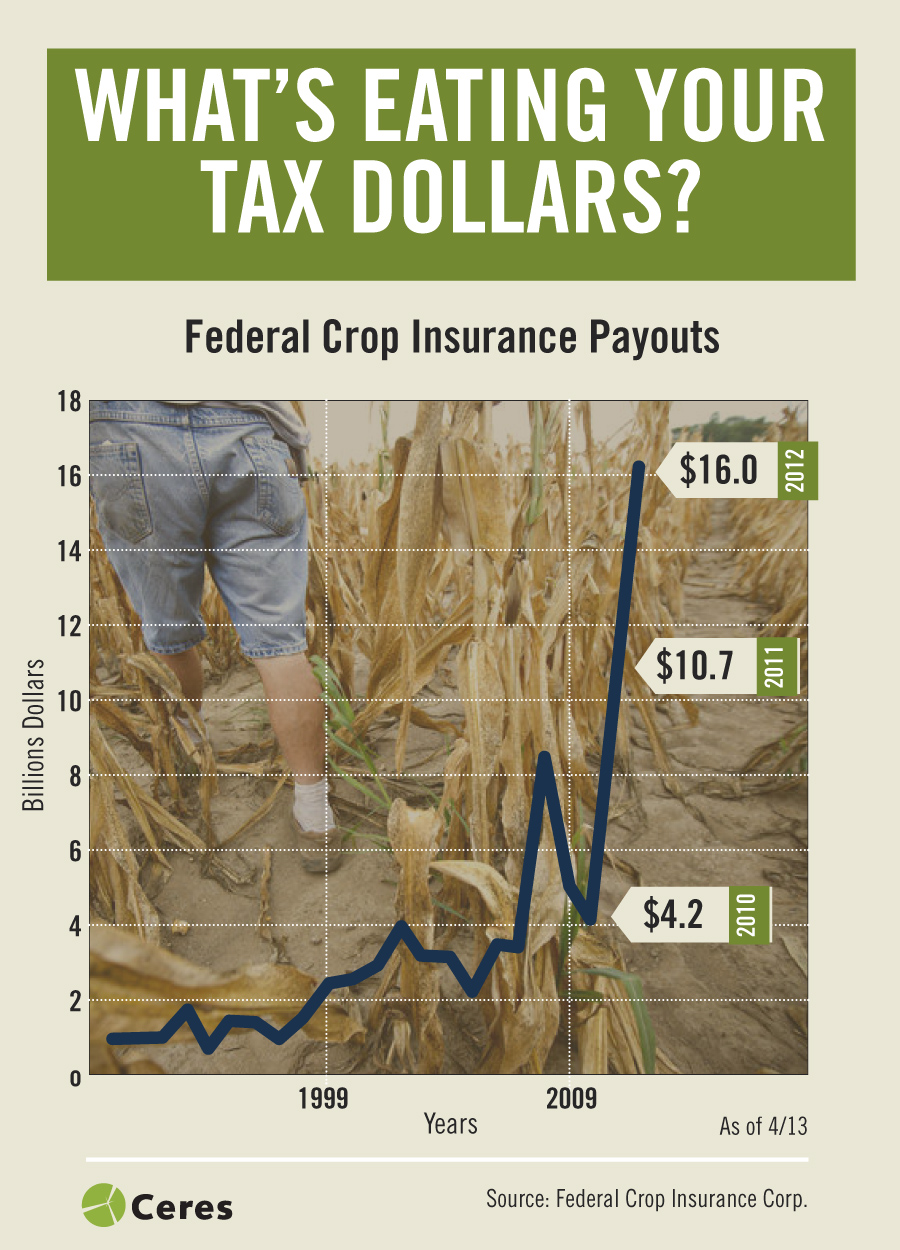

Food

Taxpayers subsidize the federal crop insurance program that was created during the 1930s Dust Bowl to protect farmers against crop losses. Today, we're experiencing another devastating drought, and federal crop insurance losses have tripled in the past three years to $16 billion in payouts for 2012. That's a cost of $51 a year for every man, woman and child in America.

Get the world’s most fascinating discoveries delivered straight to your inbox.

And these costs are likely to continue — the latest numbers from the U.S. Drought Monitor show nearly 67 percent of the contiguous U.S. is now experiencing some level of drought.

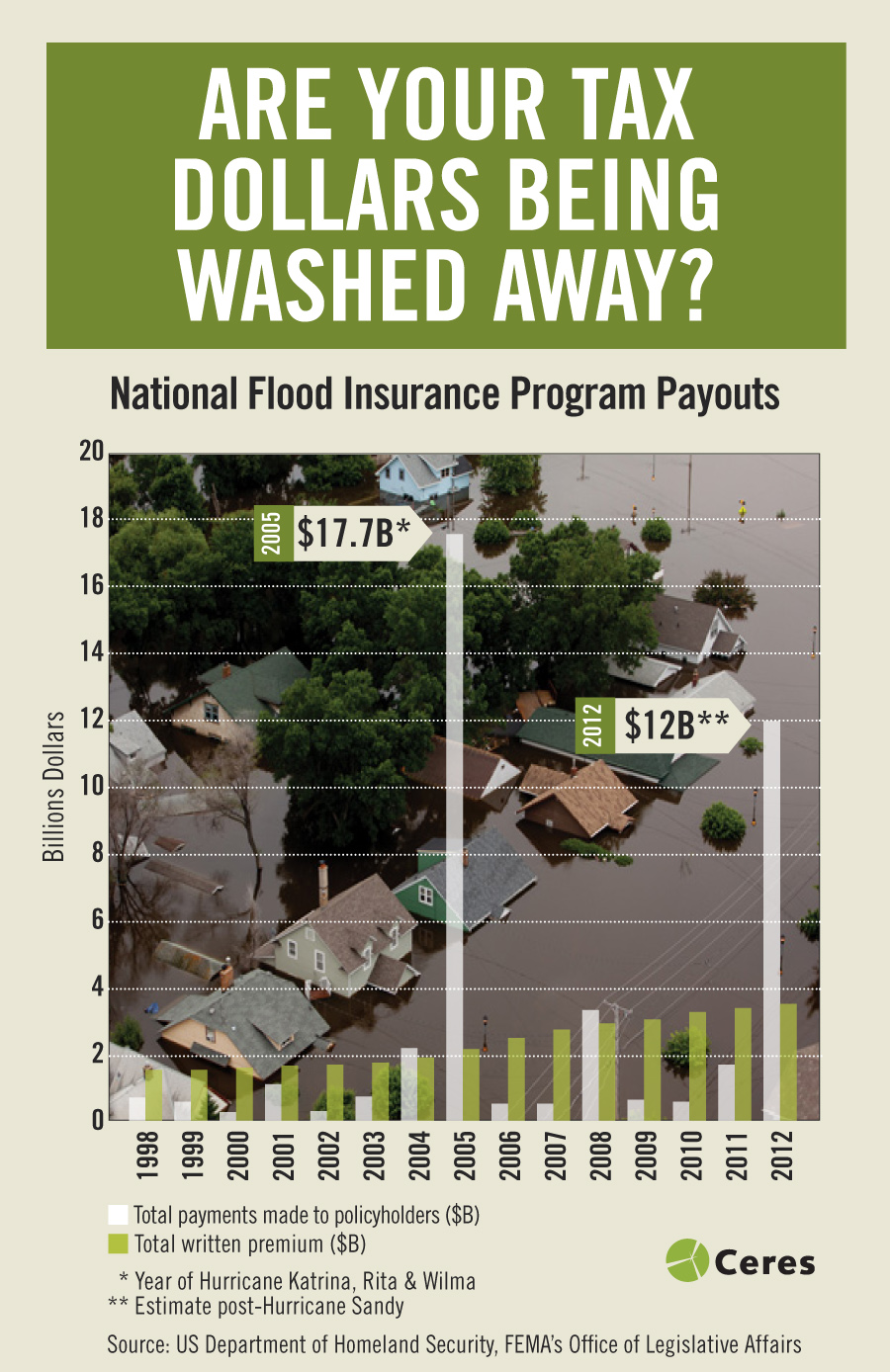

Floods

The National Flood Insurance Program (NFIP) is staggering under massive losses after Superstorm Sandy, which triggered more than 115,000 new claims in just the first two weeks after the storm.

Although NFIP collects about $3.5 billion a year in premiums, the amount of claims the agency has paid out has exceeded the amount collected in four of the past eight years, leading to increased borrowing by the federal government (in other words, taxpayers) to fill the gap. Last year's losses in Sandy's wake are expected to approach $8 billion. That's $25 for every American. [How Sandy Compares to the Worst US Natural Disasters]

Keep in mind, that figure doesn't even include the $50 billion of disaster relief that Congress approved in January for Sandy-impacted states. And with sea levels rising and storm surges reaching further inland because of climate change, risks to coastal communities and costs to taxpayers will continue to rise.

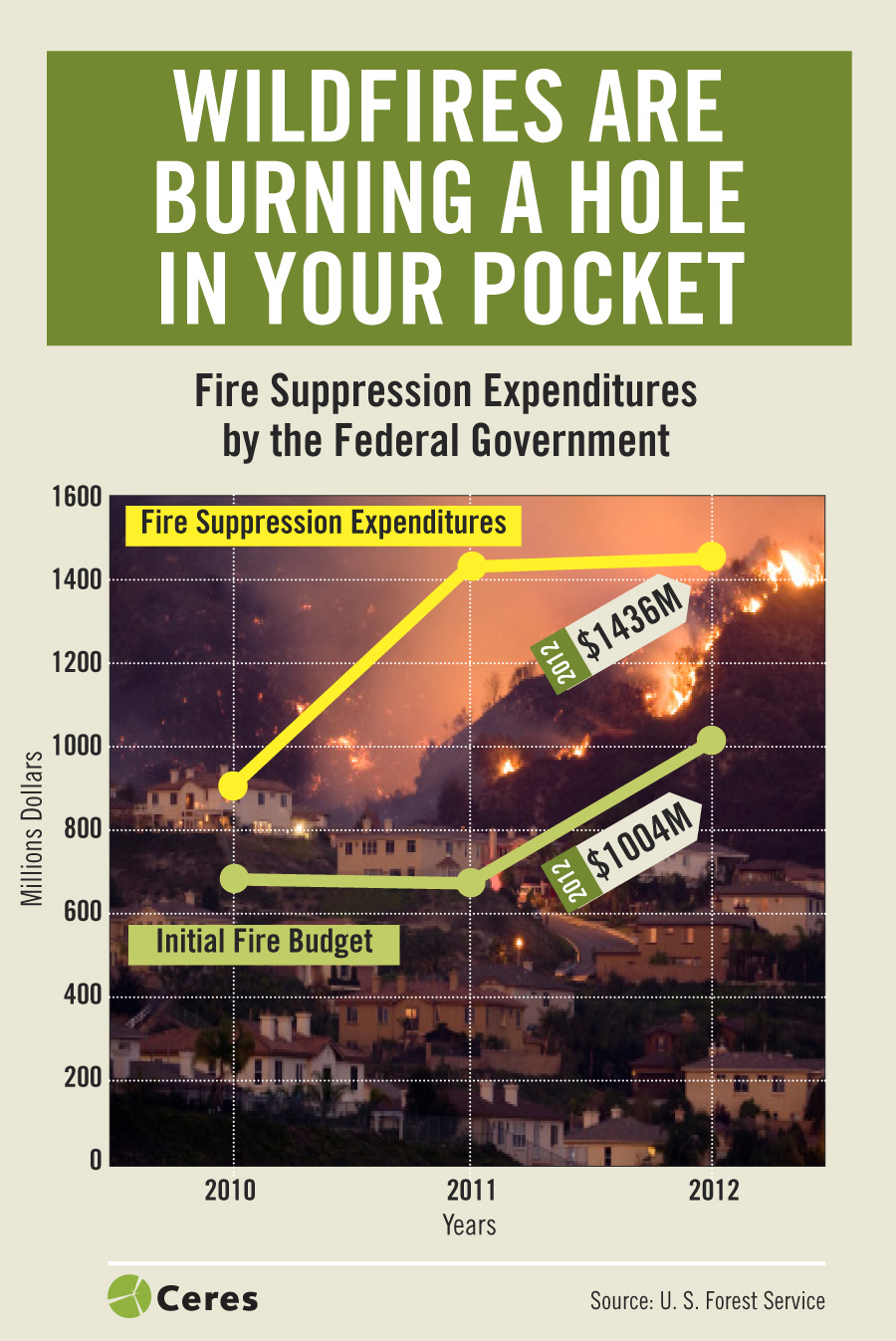

Fires

While Eastern states flood, many Western states are going up in flames. In 2012, more than nine million acres burned in wildfires — an area larger than the state of Maryland — making it the third-worst fire year in U.S. history.

In 2012, the Forest Service overspent its available fire suppression budget by $400 million, as it has almost every year for the last 20 years, transferring millions of dollars away from other land management projects. The costs are not only borne by the federal government; Wyoming and Montana spent more than $90 million of state money fighting wildfires in 2012. [Is Global Warming Fueling Colorado Wildfires?]

Climate models show a likely increase in fires in coming years, and a study by Headwaters Economics found that even a 1-degree rise in temperatures would likely lead to a 300 percent increase in acres burned and a 100 percent increase in fire-suppression costs.

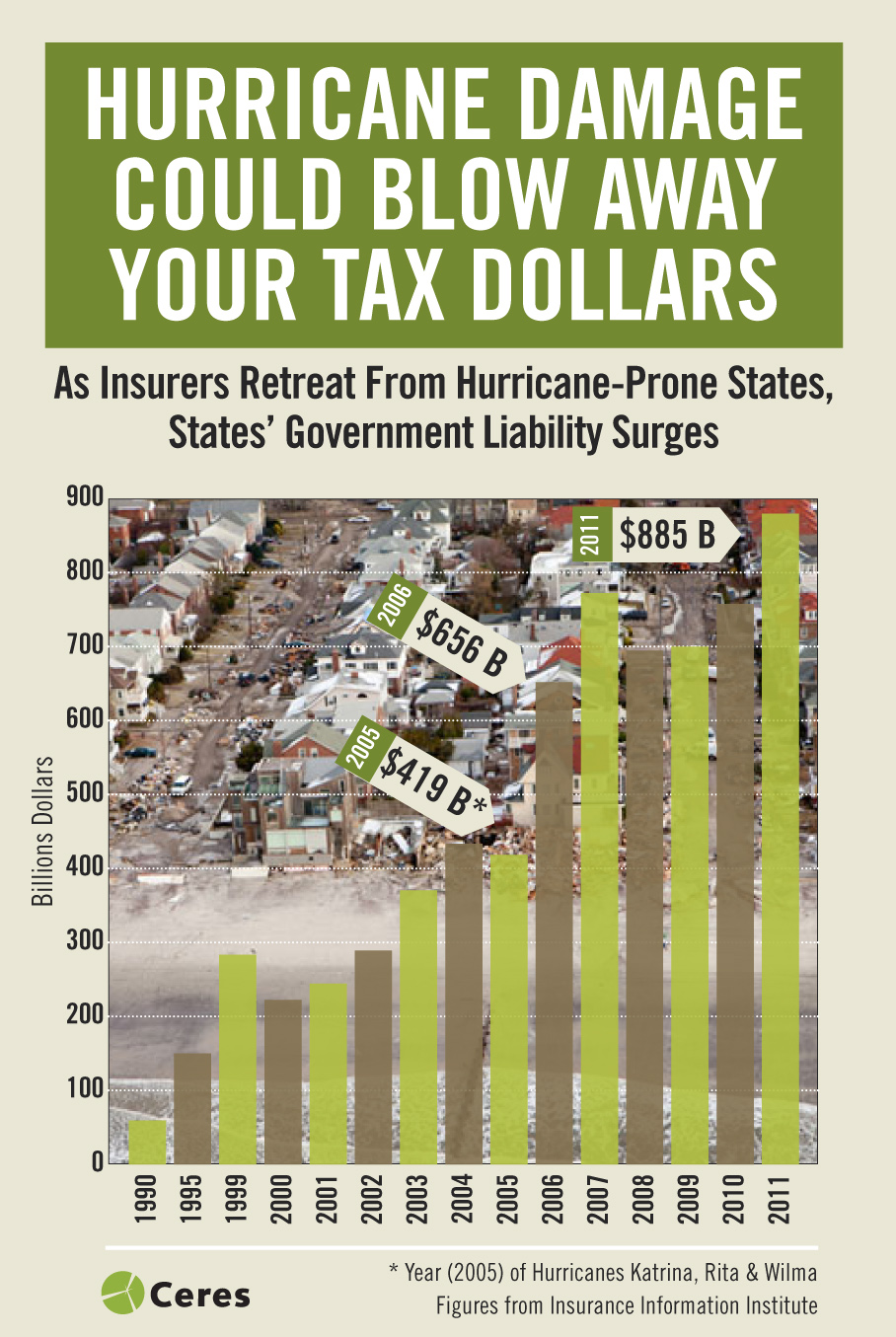

State taxpayer exposure

Extreme weather, influenced by climate change, creates other taxpayer risks. State governments are increasingly liable for the cost of hurricane damages as private insurers pull out of at-risk locations, leaving state taxpayers subsidizing insurance loss claims for homes and businesses.

The state insurer in Florida, for example, is carrying the burden of more than one million homeowners' policies — a financial catastrophe just waiting for state taxpayers the next time a major hurricane hits Florida. State government-loss exposure in hurricane-prone states (such as Florida, Texas and Massachusetts) now exceeds $885 billion, a 16-fold jump from 1990.

Those trends are chilling reminders of the sweeping economic impacts we are now all facing from warming global temperatures. As you pay your taxes on April 15, you should also consider what your political leaders — in Washington and your state capital — are doing to address climate change. Let's hope, for your wallet's sake, they're tackling the issue head-on.

The views expressed are those of the author and do not necessarily reflect the views of the publisher.

Live Science Plus

Live Science Plus